Interested in Business?

Get Business articles, news and videos right in your inbox! Sign up now.

Business + Get AlertsLiquid waste haulers appear optimistic about future prospects heading into the 2013 busy season, poised to hire new staff, present a more varied service menu, and expecting to raise revenues, according to the results of the 2012 Pumper Survey, which wrapped up last December.

An analysis of the 166 responses from pumping contractors — comparing data to the 2008 Pumper Survey — shows an improving climate for employee benefit offerings, and an expectation from pumpers that revenues and workforce numbers will be making a positive move.

The responses came from 40 U.S. states spanning from the Atlantic to Pacific oceans and north from Alaska south to Florida. Pennsylvania topped the list with a dozen responses, followed by California, Florida, Ohio, Georgia, Massachusetts, Indiana, Wisconsin, Tennessee and Texas rounding out the top 10.

Our last Pumper Survey was taken shortly after the collapse of the U.S. economy in late 2008, when failures of banks and investment houses caused a deep recession and threatened to throw the economy into a catastrophe approaching the Great Depression of the 1930s. Fortunately, the perilous slide halted before reaching a depression, according to economists, and there were some signs of a rebound rather quickly.

ON THE MOVE

In my contacts with pumping professionals in the past few years, it always seemed like the wastewater industry was somewhat insulated from the worst of the recession. Yes, many contractors told me their businesses suffered in 2009 and beyond, and many reported having to trim expenses with staff cuts and selling off equipment for a time. But, on the whole, pumpers seemed to be buoyed by a continuing demand for their service.

The last few years seem to have brought a resurgence in the industry, as pumpers are replacing older equipment they've nursed through the lean times. They're seeing business pick up as well, as many pumpers I talk to are putting in long hours trying to keep up customer service. Many seem on the cusp of having to hire new employees after working with a bare-bones crew for some time.

The 2012 survey results reflect some of the anecdotal evidence I've seen of late. Forward-looking questions — new to the updated survey — about revenue and staffing are telling. When we asked contractors about projected revenues for this year, 49 percent said they expected an increase, 40 percent expected similar performance to 2012, and only 12 percent expected a decline.

The respondents presented a hopeful employment outlook for this year as well, with 29 percent saying they expect to add staff this year, and 67 percent saying the workforce will stay about the same. Only 4 percent said they expect a decline in staff this year, which is an about-face from the gloomier reports I was getting from pumping companies a few

years ago.

HITTING THE HIGHLIGHTS

We're publishing the full survey responses here, but a few statistics jumped out at me and may prove valuable for pumping companies large and small as you plan for the upcoming busy season. Among the observations I find most interesting:

We've determined a baseline for average technician pay.

Since we didn't ask contractors specifically how much they paid technicians in the earlier survey, the new survey's numbers set the baseline for future comparisons for where wages are going. According to our respondents, the vast majority of driver-technicians (79 percent) are being paid $10 to $22 per hour, with the most (32 percent) earning $14 to $18 per hour. About the same percentage is being paid for either less than $10 (5 percent) or more than $30 (6 percent).

How are the workers being paid? Most (77 percent) are being paid an hourly wage, while smaller numbers earn salaries, bonuses or commissions. The share of hourly workers is up over 2008, while the number of employees who earn bonuses has dropped from 20 to 14 percent.

There is a new and surprising direction in employee benefits.

Given the tremendous concern over rising employee health care costs and worry over President Obama's Affordable Care Act, it's interesting to note that the number of respondents offering a health insurance benefit is up 10 percent, from 34 percent in 2008 to 44 percent. The question remains if more employers are determining that providing health care coverage promotes employee retention, helps keep workers healthier and thus more productive, or a combination of both.

Other benefits changes of note include a 6 percent increase in paid vacation offerings in the most recent survey, to 60 percent. Also, we asked about company-provided mobile phones this year as the technology has become mainstream in recent years, and 52 percent of respondents said they provide cellphones to their employees.

Service diversification may be a key to future success.

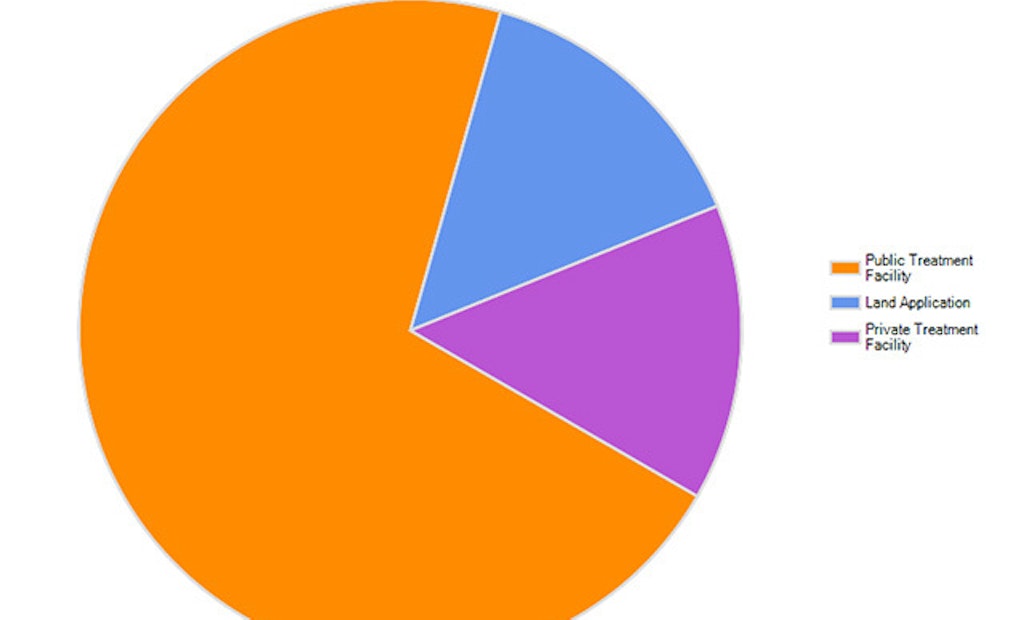

The new survey shows that if your com-pany is not adding more specialized equipment to bolster your menu of services, you're in the minority. Responses show a definite move into more commercial and industrial pumping, as well as onsite system installation and portable sanitation.

Commercial sep-tic garnered only 31 percent of contractor responses in 2008; the number has grown to 74.2 percent this year. Sewer and drain-cleaning services grew from 22 percent in 2008 to 49 percent in the recent survey. Only 24 percent of pumpers in 2008 said they installed systems; that number has nearly doubled to 43 percent. While 12 percent reported handling portable restrooms in 2008, that number has ballooned to 43 percent.

Other new services mentioned by respon-dents included excavation, lift-pump service, plumbing, concrete work, biosolids application, food-waste hauling, video inspection, soil testing, hydroexcavation, and rental and repair of vacuum trucks.

Fuel costs are the new top challenge.

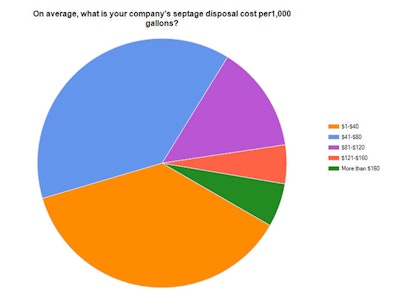

The cost of fuel is the top challenge faced by pumpers, eclipsing the biggest challenges listed in 2008: finding new customers and disposal costs. The reason could be wildly fluctuating, but generally, higher diesel pump prices topping $4 per gallon is a concern. Or it could have something to do with relatively little upward movement in disposal costs since the last survey.

Based on the cost of disposal for each 1,000 gallons dumped, 39 percent of respondents said they pay between $41 and $80 in the new survey, compared to 38 percent in 2008. Another 36.5 percent said they pay $1 to $40 now, compared to 34 percent in 2008. Similarly, the amount contractors charge per residential pump-out has seen little change. This seems to indicate that adding to crews is the direct result of additional workload, not due to higher profits.

WHERE DO WE GO FROM HERE?

While challenges clearly remain, the survey shows there is reason for optimism in the industry. Faced with historic economic problems four years ago, pumpers responded in smart and savvy ways to blunt the impact of the downturn and position themselves for better days ahead.

Contractors emerge from the recession battle-tested and with the knowledge that wastewater remains an excellent place to earn a living. We know there will be a strong and growing demand for these essential services, driven by a never-ending need to handle all sorts of sludges and the value of a clean environment. And we know that those contractors who attain the highest level of professionalism, keep up with technology trends and new equipment, and treat their employees right will get the lion's share of the work.

The results of this survey will help drive our editorial emphasis in the coming year. When we talk to contractors, we'll ask about the important issues you reported and seek answers to your greatest concerns. Thanks to everyone who responded to the survey. Your contribution will help the entire industry grow and improve.